Total Budget - The largest in New York State history

Executive Budget Overview

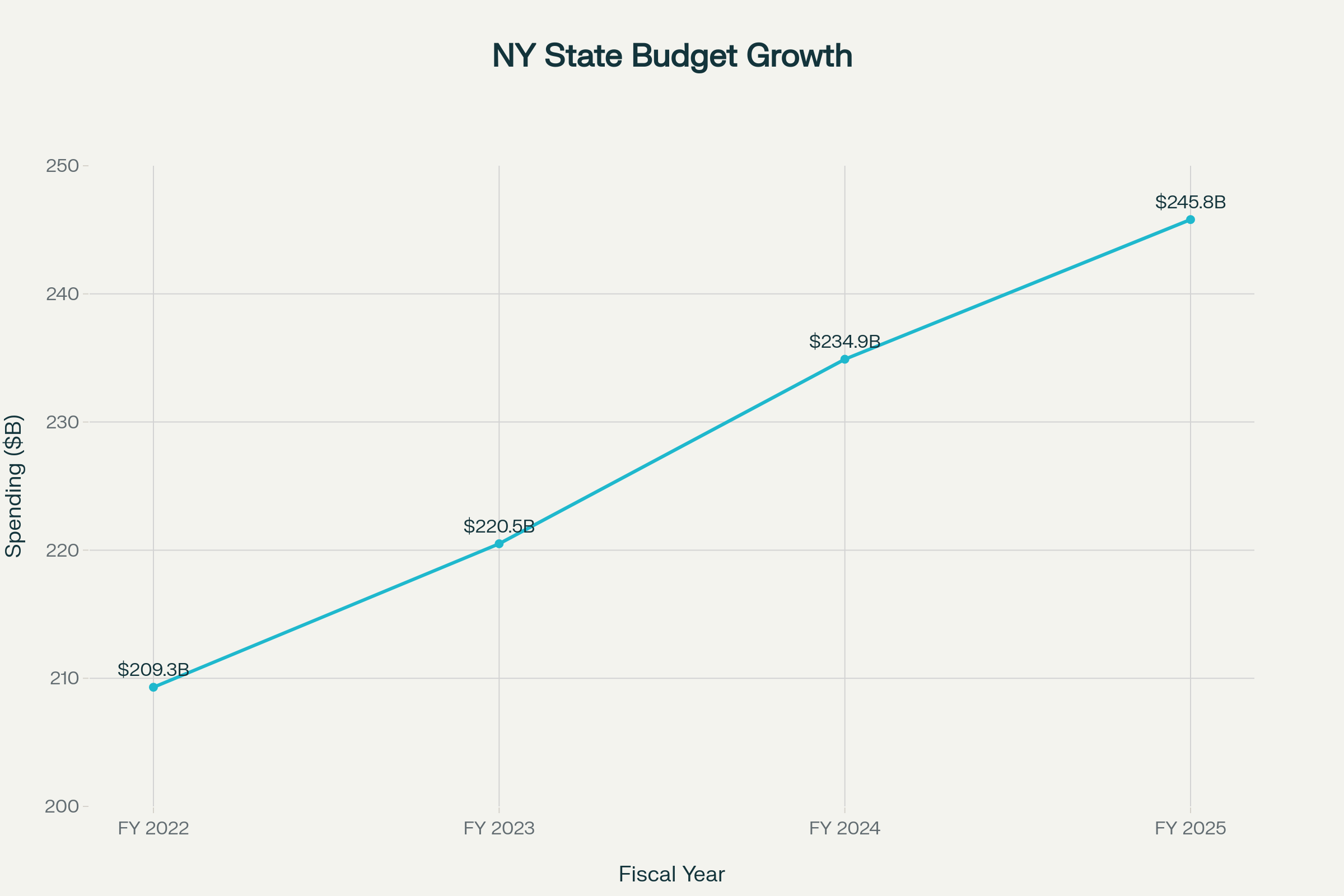

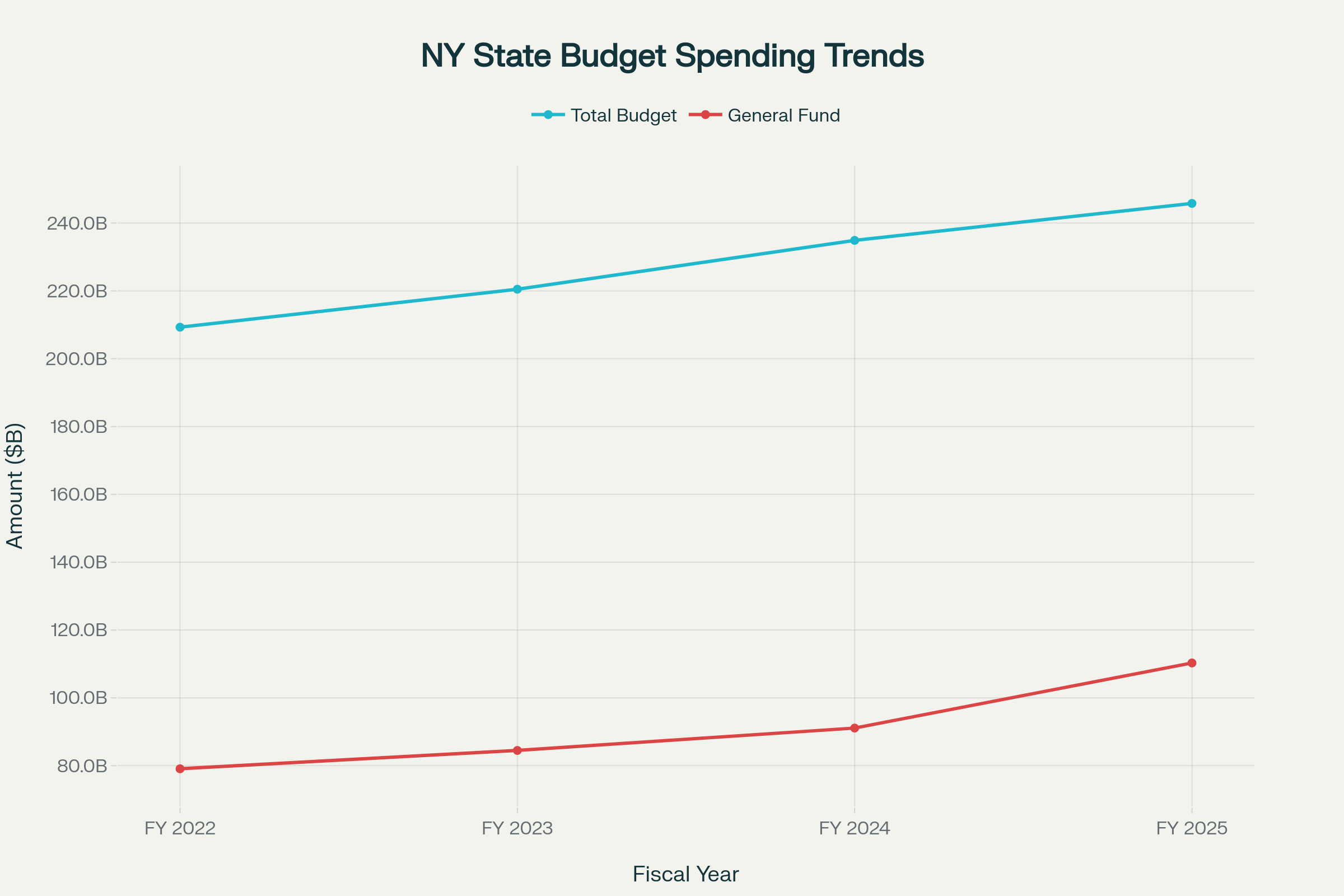

New York State's Fiscal Year 2024 Executive Budget, totaling $245.8 billion, represented Governor Kathy Hochul's comprehensive fiscal plan to address the state's critical needs while maintaining fiscal responsibility. The budget reflected "New York's steady finances, even as global economic trends send mixed signals" and was balanced without any new increases in State income tax.

Revenue Performance and Year-Over-Year Growth

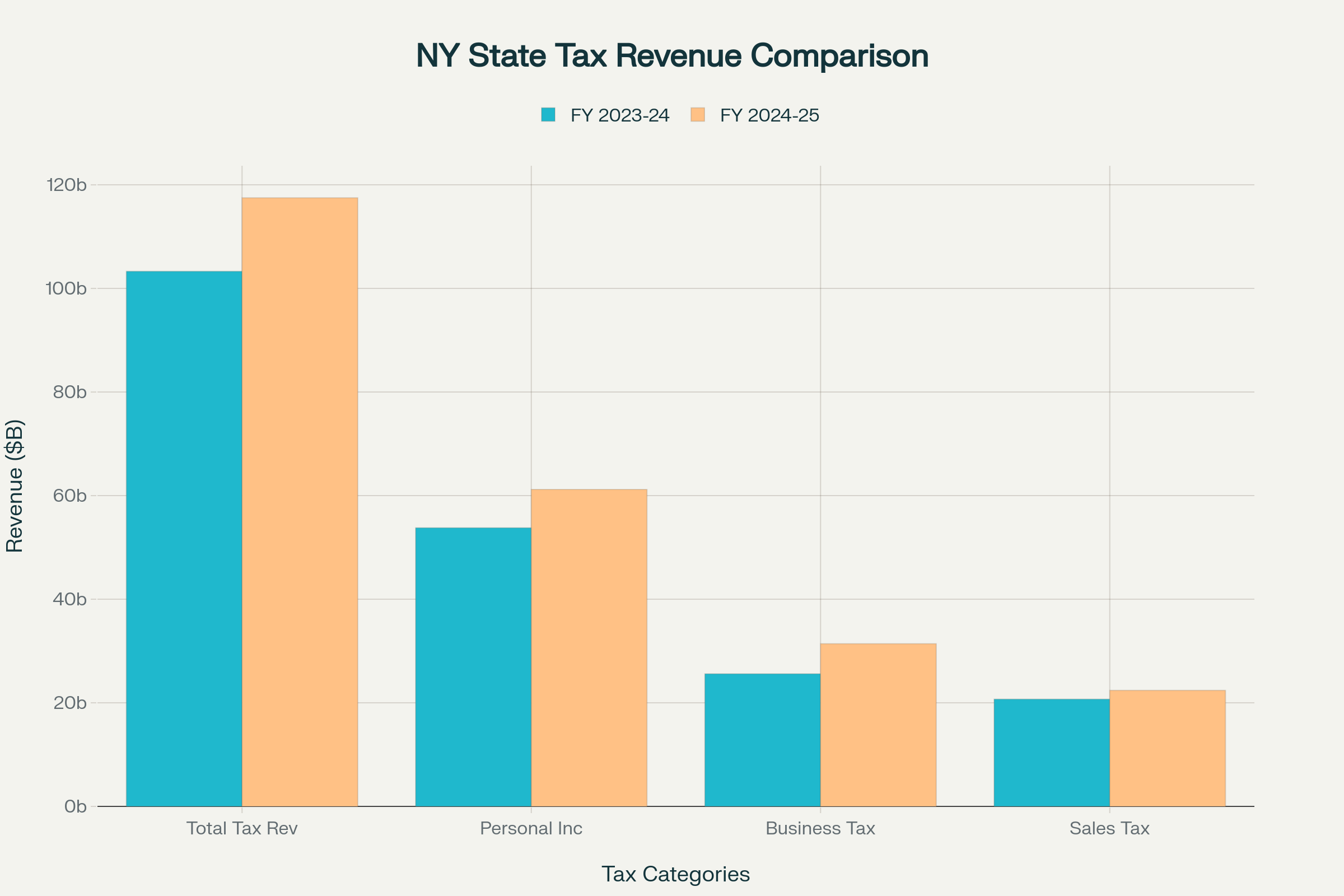

New York State's revenue performance in FY 2024-25 significantly exceeded projections, with tax collections totaling $117.5 billion compared to the Division of Budget's forecast of $115.4 billion. This $2.1 billion surplus demonstrates the strength of the state's tax base and economic fundamentals.

Key Revenue Highlights:

- Personal Income Tax: $61.2B (13.8% increase)

- Business Taxes: $31.4B (22.7% increase)

- Sales Taxes: $22.4B (8.2% increase)

- Total Tax Revenue Growth: 13.7%

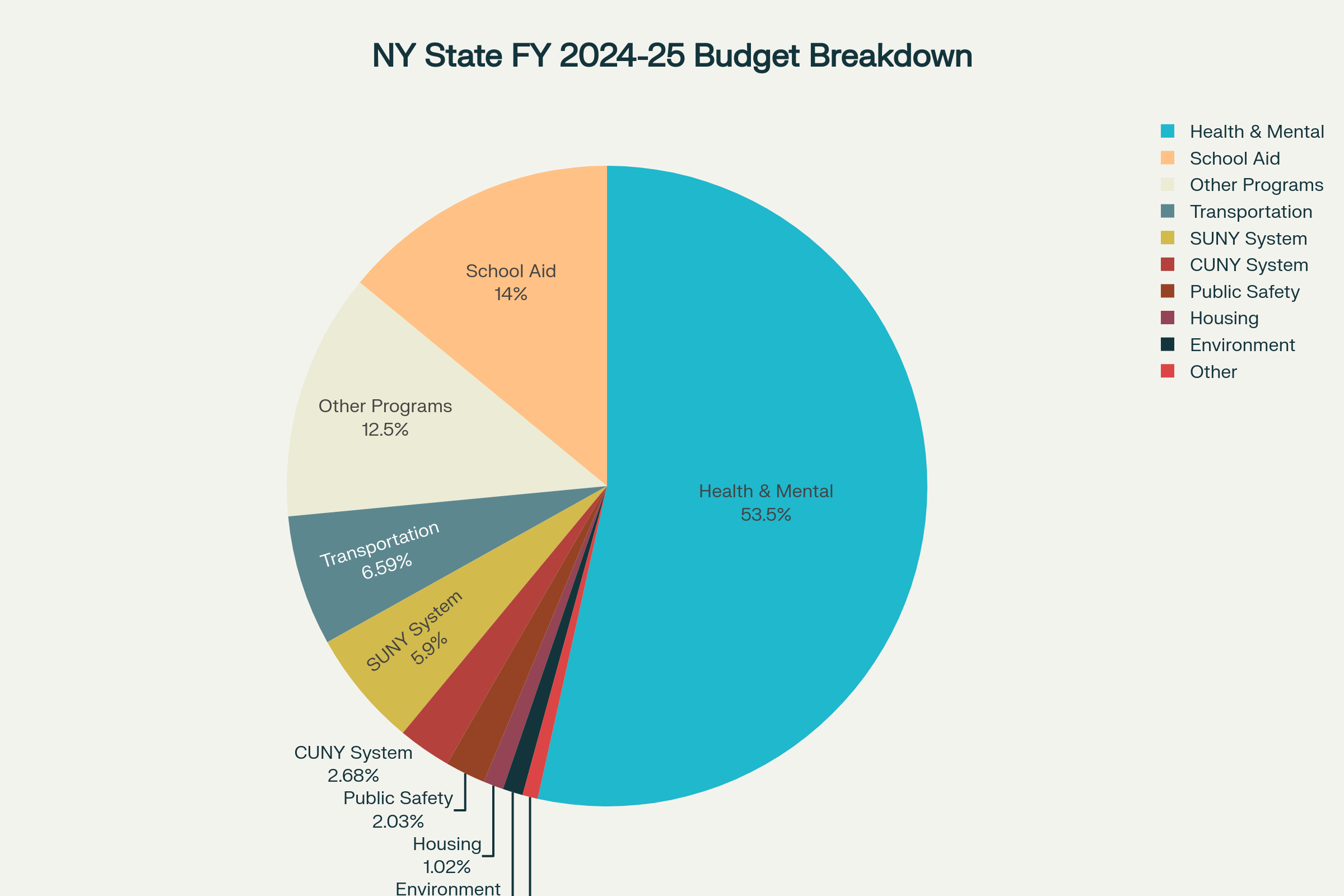

Spending Categories and Budget Allocation

The FY 2024-25 budget allocates resources across major functional areas, with Health and Mental Health services commanding the largest share at $131.5 billion or 53.5% of total spending.

Major Spending Categories:

- Health & Mental Health: $131.5B (53.5%)

- Education (School Aid): $34.5B (14.0%)

- Transportation: $16.2B (6.6%)

- SUNY System: $14.5B (5.9%)

- CUNY System: $6.6B (2.7%)

- Public Safety & Criminal Justice: $5.0B (2.0%)

Mental Health Investment and Healthcare Priorities

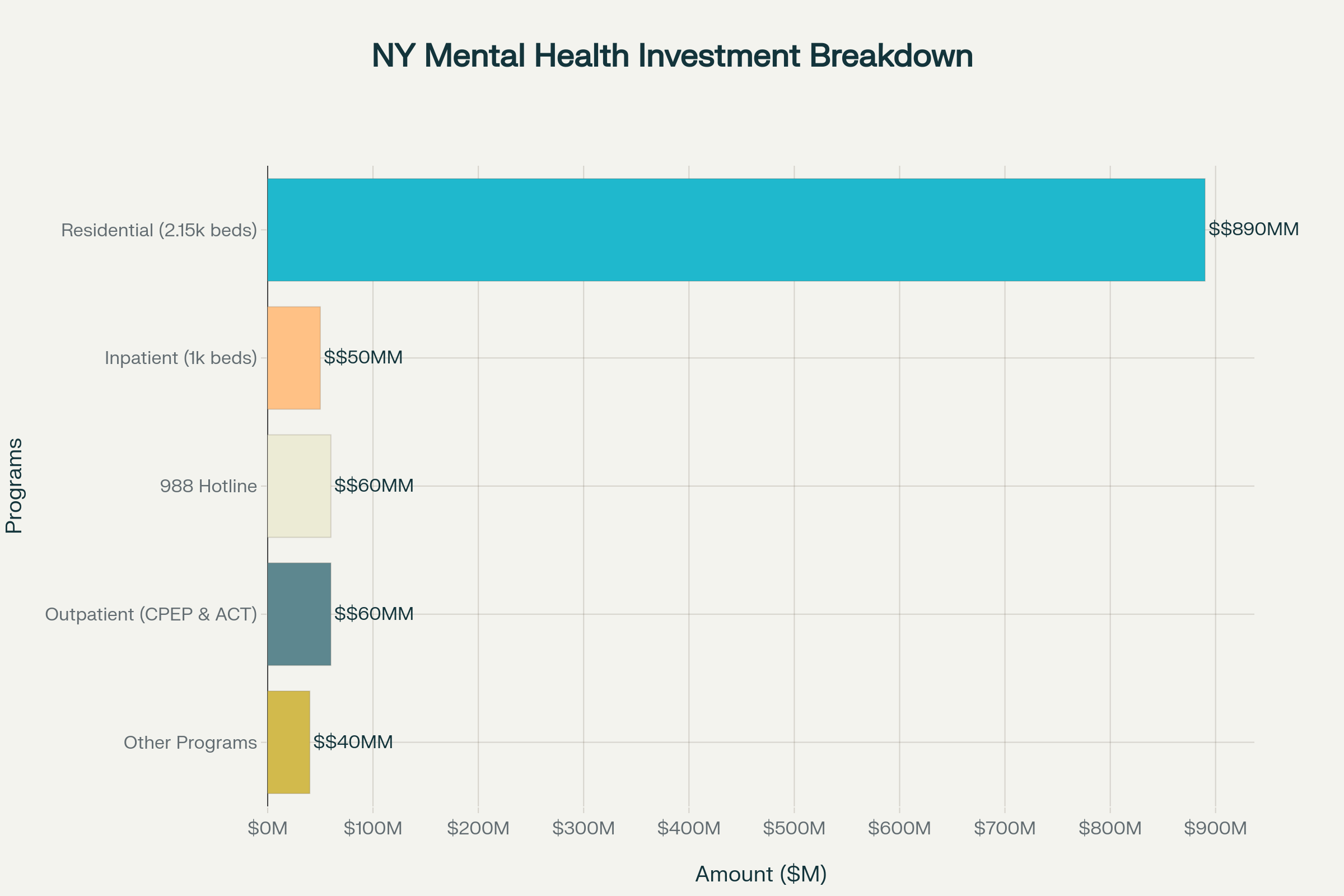

New York State's $1 billion multi-year mental health investment represents the most comprehensive overhaul of mental health services since deinstitutionalization in the 1970s. This transformative investment addresses critical gaps in the state's mental health continuum through strategic facility expansion and service enhancement.

Mental Health Investment Components:

- $890M for 2,150 new residential beds

- 1,000 new inpatient psychiatric beds

- $60M for 988 Crisis Hotline expansion

- 12 new Comprehensive Psychiatric Emergency Programs

- 42 new Assertive Community Treatment teams

Education Funding

The FY 2024 Budget made historic investments in education with $34.5 billion in total School Aid, representing the highest level of State aid in history. This constituted the largest year-to-year increase ever at $3.1 billion (10.0 percent).

Education Investment Highlights:

- Foundation Aid: $2.7B increase (12.8%)

- Learning Loss Recovery: $250M for tutoring programs

- Pre-K Expansion: $125M for full-day programs

- First time Foundation Aid fully funded in 17-year history

Financial Performance and Outcomes

According to the New York State Comptroller, tax collections for State Fiscal Year 2024-25 totaled $117.5 billion, which was $2.1 billion higher than forecast by the Division of the Budget. Tax collections were $11.1 billion (10.4%) higher than the previous year.

Key Performance Metrics:

- Revenue exceeded projections by $2.1B

- Personal Income Tax collections: $61.2B (+13.7%)

- Business tax collections: $31.4B (+13.3%)

- Debt position stable at $64.4B (3.8% of personal income)

- Reserves completed two years ahead of schedule

Conclusion

New York State's FY 2024 Executive Budget represents a comprehensive fiscal plan that balances ambitious policy goals with responsible financial management. The $245.8 billion budget successfully addresses critical needs in mental health, education, and public safety while maintaining strong fiscal reserves and avoiding broad-based tax increases on middle-class families.

Revenue growth of 13.7% provides a solid foundation for sustained investments, though future fiscal planning must account for scheduled tax reductions and evolving economic conditions. The enacted FY 2024 Budget successfully balanced spending with revenues while making substantial investments in critical areas, positioning New York State for continued economic growth and improved quality of life for its residents.